I.

Pop quiz: What does an aspiring rapper and a tech entrepreneur have in common?

The perfect crime.

Well, almost perfect.

Earlier this year, a young married couple appeared in a federal court.

Charges: attempts to launder money from a previous 2016 BTC hack worth over $4.5 billion at the time they were arrested. They’re not being charged with the hack itself.

The Feds have since seized about $3.6 billion worth of that total.

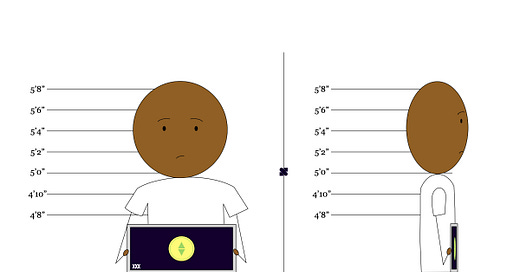

On the outside, Dutch Ilya Lichtenstein and Heather Morgan seemed like a run-of-the-mill pair.

Heather was a writer and entrepreneur, creating her hip-hop artist repertoire under the pseudonym Razzlekhan. Dutch, on the other hand, described himself as a human angel investor, web3 developer and serial entrepreneur (at least on his Twitter account).

Before this bust—which included the police seizing their multiple SIM cards, burner cell phones and, you know, other classic scammy stuff— the two had crafted an online presence that revolved around tech and the web3 space. Perhaps this played into why the allegation against this unlikely duo became more plausible.

Because they weren’t just jejune crypto users. Clearly, they were well-versed in this technology.

This was also why prosecutors didn't buy the whole ‘naive wife unknowingly roped in’ story.

“It bears noting that Ms Morgan is highly intelligent, with a graduate degree in economics, and has sufficient cryptocurrency and technical know-how such that if she were released, even if her husband burned the keys, she would absolutely have the ability and the connections to access the stolen crypto to purchase identities off of the dark net and disappear.”

In an ironic twist, she had often interviewed virtual currency exchange employees to discuss their anti-money laundering and anti-fraud policies for her online finance articles. She had even tweeted about possibly making a “rap song about fraud prevention”.

The couple used a series of minor transactions to move large sums of crypto—what is known as a peel chain. They’re also alleged to have mobilised funds across the dark-Web marketplace back into other coin exchanges.

Fortunately, several of these exchange platforms could not verify their accounts, leading to some of the funds being frozen.

Perhaps they really were just trying to show the lapses in the system. Oh, that and make a couple of billions of dollars before they jet off to Ukraine to start a family with their stored frozen embryos.

II.

“Cryptocurrency-based crime hit a new all-time high in 2021, with illicit addresses receiving $14 billion over the course of the year, up from $7.8 billion in 2020” Chainalysis Crime Report (2021)

Last week, we discussed how crypto scams are possible despite such sophisticated technology. What appears to be the blockchain’s greatest asset can also be its downfall, if care isn't taken.

The charge against the above couple is not the first—nor will be the last—of crypto-related laundering crimes noted to date.

As of earlier this year, illicit addresses are said to hold at least $10 billion worth of crypto, although this estimated value comes from subsequent price fluctuations of these crypto assets. A significant portion of this comes from money laundering, and these are related to only online dealings. Who knows what happens offline?

In contrast, the UN Office of Drug and Crime approximates that almost $2 trillion (can be as low as $800 billion) of fiat currency is laundered per year. While crypto crime is nowhere near this figure, the fact remains that crime is a menace that respects no platform or technology. (After all, it’s not a competition to see who’s the lesser evil).

This begs the question: is there anything we can do about this?

III.

While the majority of its users are law-abiding, there will always be those looking for a way to game the cryptosystem. Measures need to be in place to minimise the efforts of these actors in bad faith.

The onus lies with the different stakeholders, such as the exchange platforms themselves. Adequate know-your-customer and AML (anti-money laundering) policies should be the rule rather than an exception.

Beyond this, government agencies and policy-makers have a role to play as well: so much for being entirely decentralised. The fact remains that they are still the highest authority when it comes to law enforcement and overall judicial matters.

For example, the U.S. Treasury Department’s Office of Foreign Assets Control sanctioned two notorious crypto exchange platforms—Suex and Chatex. In fact, the Federal Bureau of Investigation was said to help train Nigerian crypto crime investigators.

Basically, for every one step of illicit transactions, we need to be two steps ahead.

In all honesty, I understand anyone’s hesitation toward the crypto space.

Perhaps this is why some experts advise keeping crypto investments under 5% of one’s entire portfolio, especially for those with a lower risk appetite.

But all hope isn't lost.

According to Chainalysis reports, crypto-based crime is on a downward trend, perhaps because law enforcement agents are becoming more accustomed to and informed about this new technology.

Whether it’s a seemingly unassuming couple or two Chinese citizens (Tian Yinyin and Li Jiadong, who successfully opened fake accounts on other exchanges and have been charged for their crimes in absentia), crypto-related crimes continue to evolve. And so do efforts to stop them.

Thought-provoking:

In a utopian world, this wouldn't need to be a thing. We would all get along, hold hands around the fire and sing kumbaya till the sun comes up.

Now wouldn't that be just perfect?

This is a really interesting read. Thank you for pushing out this information.